There’s a new technology on the horizon that’s gaining a lot of traction – Metaverse. As the name suggests, Metaverse is a virtual world that can offer several benefits.

In this article, we’ll explore some of these benefits and discuss how Metaverse might be able to help improve your finances in the near future. We’ll also discuss how Metaverse can be used to enhance banking activities. So whether you’re interested in exploring Metaverse’s potential benefits for yourself or want to recommend it to a friend, read on!

What is Metaverse?

Metaverse is a concept that was first introduced by Neal Stephenson in his 2000 novel Snow Crash.

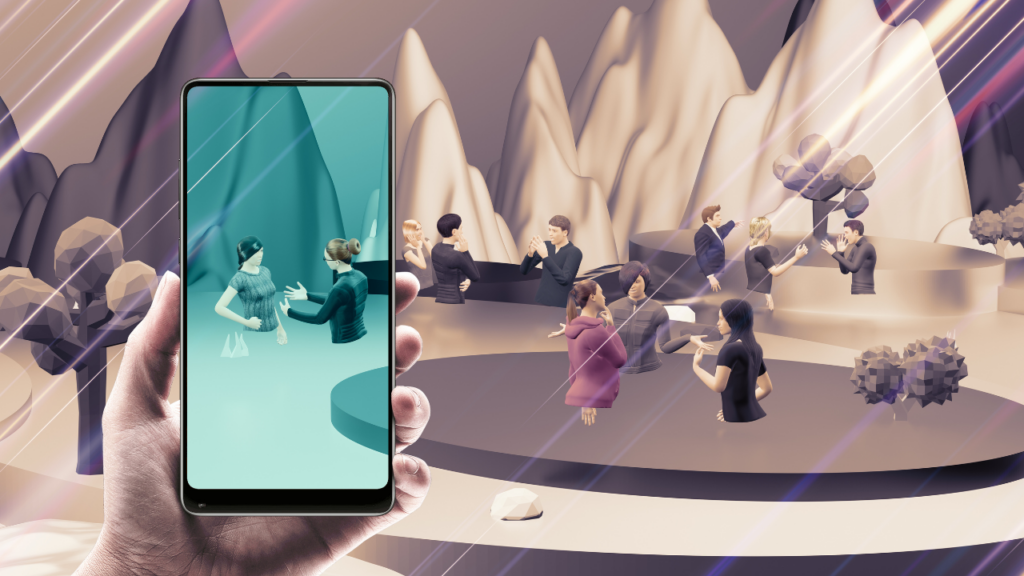

The “metaverse” can be described as a virtual shared space where people can virtually interact and engage with each other, services and products. It allows users to combine different assets and applications into one virtual world.

In other words, it is a virtual world that combines elements of the real world with the digital world, allowing people to interact with each other and with virtual objects and experiences in a natural and immersive way.

The Metaverse concept is still largely theoretical and yet to be fully explored. However, some people believe that it has the potential to revolutionise various industries, including banking, education, entertainment, and more.

The use of virtual reality and other immersive technologies in the Metaverse could create unique and engaging customer experiences and new and innovative ways of delivering services and products. For example, Metaverse could be a valuable tool for managing and tracking projects for business owners. Likewise, gamers could use the platform to socialise and trade digital assets. In the future, Metaverse has the potential to revolutionise how people use software, making it more engaging and easier to use.

Read More:

McDonald is aiming for Metaverse?

Indian PSU Bank to launch metaverse lounge

How can Metaverse improve banking?

In the context of banking, the Metaverse could potentially be used to create virtual branches or other virtual spaces where customers can interact with bank representatives and access financial services. This could make banking more convenient and accessible for customers, as they could access services from anywhere in the world. Additionally, the use of virtual reality and other immersive technologies in the Metaverse could allow for the creation of unique and engaging customer experiences.

Some potential examples of how the Metaverse could be used in the banking industry include:

- Creating virtual branches where customers can access financial services and interact with bank representatives

- Using virtual reality and other immersive technologies to create unique and engaging customer experiences

- Allowing customers to access and manage their accounts, transfer money, and perform other banking tasks from anywhere in the world

- Providing customers with personalised financial advice and recommendations based on their individual needs and goals

Additionally, using the Metaverse could allow for the creation of virtual financial advisors or other virtual assistants that could help customers navigate the account creation process. For example, these virtual assistants could provide personalised guidance and support to help customers complete the necessary forms and provide the information to open an account.

How can Metaverse improve fund management in banking?

The banking industry is currently in a state of flux, with new technologies emerging that have the potential to change the way we bank.

However, using the Metaverse in the banking industry could improve funds management in several ways.

For example, the use of virtual reality and other immersive technologies could allow for the creation of unique and engaging customer experiences, which could potentially improve customer satisfaction and loyalty. This, in turn, could lead to increased customer engagement and potentially higher levels of customer deposits and other funds managed by the bank.

Additionally, using the Metaverse could allow for the creation of virtual financial advisors or other virtual assistants that could help customers manage their funds more effectively. For example, these virtual assistants could provide personalised financial advice and recommendations based on a customer’s needs and goals, which could help them make more informed decisions about their finances.

Way forward

Metaverse is a new digital platform that has the potential to revolutionise the financial world. It can improve our financial lives in ways we never thought possible. Not to mention, the blockchain technology that underlies Metaverse makes it an incredibly secure platform. But, in the end, it will depend on how banks implement it to improve the customer experience.