Paytm Bank, which is ceasing its services by March 15, provided a range of services including savings accounts, fixed deposits, debit cards, UPI, and bill payments. If you are looking for alternative options to store your money digitally without maintaining a minimum balance, there are several other digital banks available in India that offer higher interest rates, lower fees, and more features than Paytm Bank. Today we will talk about the top 5 digital banks in India that not only offer better interest rates than Paytm Bank but are also zero-balance in nature.

2.75% Interest Rate Per Annum

The Bank of Baroda B3 Silver Savings account is a digital zero-balance savings account offering a minimum interest rate of 2.75% per annum with a balance below Rs 1 lakh. It has a completely digital end-to-end account opening process with the facility of Video KYC. One can also avail of an instant Virtual Debit card.

3.0% Interest Rate Per Annum

First Select from IDFC once again a zero balance savings account where the interest rates begin at 3.0% and go up to 7.0% with a balance of up to 50 crores. Further, the interest is paid on a monthly basis compared to quarterly payments in most other banks. You also get features like VISA Signature Debit Card, free general banking services and more.

3.05% Interest Rate Quarterly

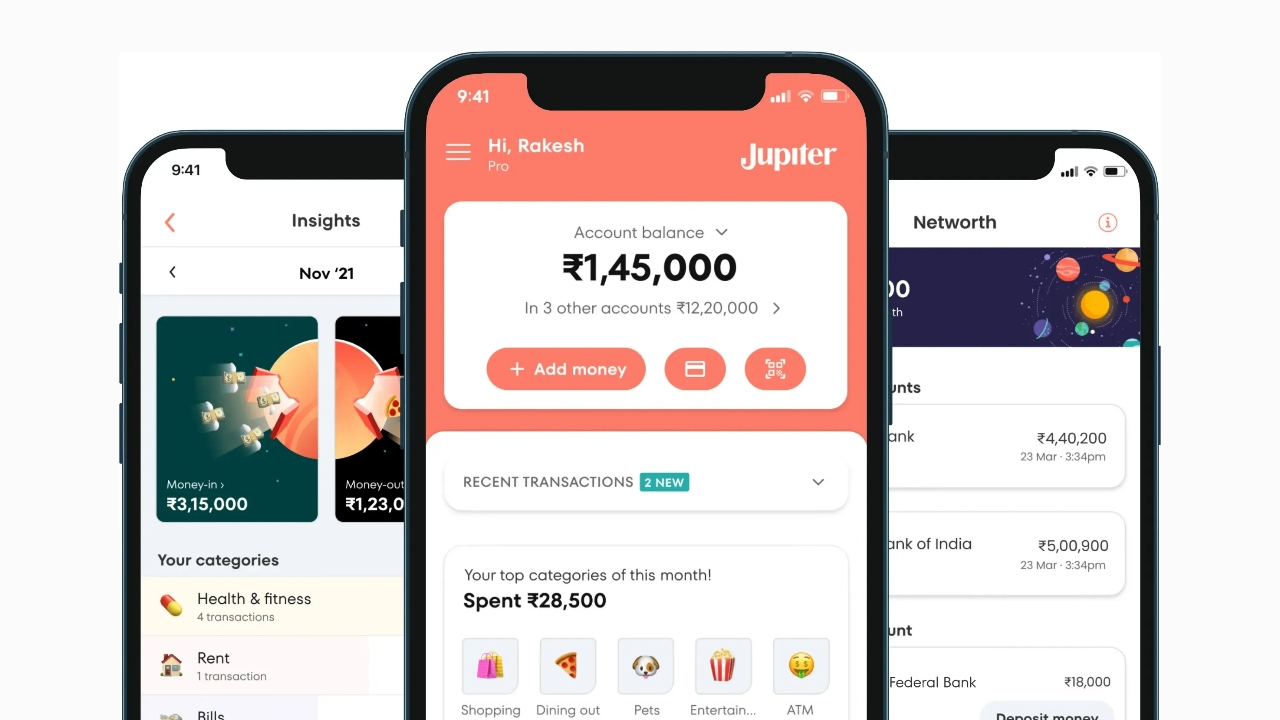

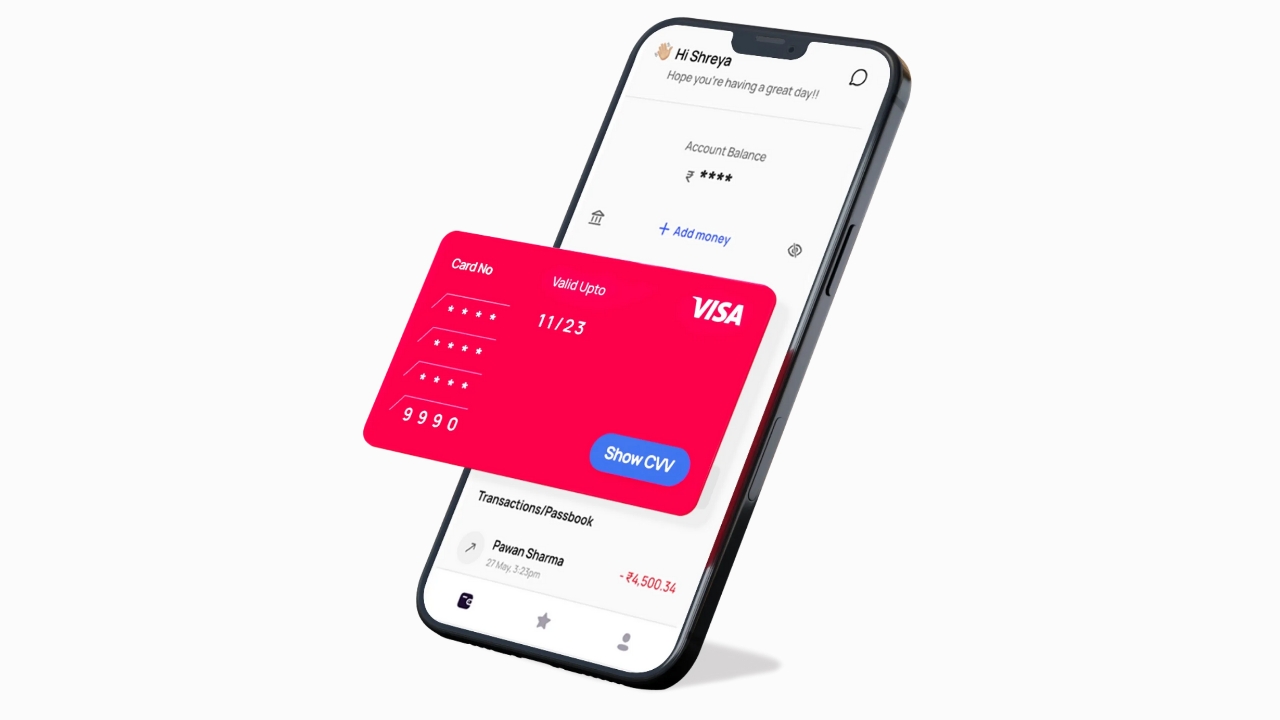

Jupiter is a digital banking platform that offers a zero-balance savings account opened in partnership with the Federal Bank. The bank provides you with an interest rate of 3.05% on your balance of less than Rs 5,00,000 every quarter—the interest rate increases as your account balances increase.

It is marketed as an all-in-one App for banking needs where most of the operations can be done through the app. Jupiter provides round-the-clock customer support and lets customers complete the KYC process digitally via a video call.

Read More: Top 5 Alternatives of Paytm Payments Bank for your Digital Banks needs

4% Interest Rate Per Annum

Kotak 811 Zero Balance Savings Account is distinct from the regular Kotak bank account and can be opened entirely online. It provides double the interest rate of what Paytm Payments bank offers and that’s 4% interest p.a. But there is a catch! A 4% interest rate is provided on a savings account balance above Rs 50 lakhs and 3.50% interest p.a. on a savings account balance up to Rs 50 lakhs.

4.25% Interest Rate Per Annum

This account from RBL bank is a zero balance savings account where it will offer interest rate of 4.25% for a balance below Rs 1 lakh, 5.50% up to 10 lakhs and so on, the interest rate increases up to 7.50% at a maximum. The account will also offer a free RuPay debit card, online bill payment services, phone banking, mobile banking, SMS banking and alerts, e-statements, internet banking services and more.

.