Tencent-owned Messaging application, WeChat is all set to introduce the Unified Payment Interface (UPI) bases payments application in India. The company has reportedly partnered with three banks for its upcoming application.

As per a report by Entrackr, senior officials of Tencent met National Payment Corporation of India (NPCI) executives three weeks ago for obtaining a license for the payment application. The company has already partnered with three banks including Axis Bank, HDFC and ICICI Bank. The report further highlights that the Chinese company wants to have its own UPI handle for the payment application.

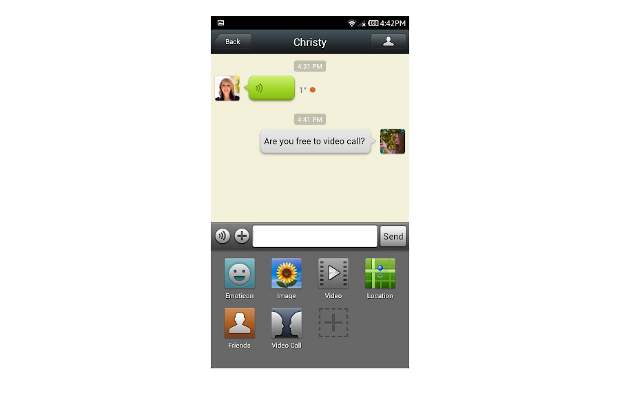

The payment application will be known as WeChat Pay, which is the same name used for the Chinese market. Furthermore, the report says that the company is looking to launch the payment-based application by the end of May-June. Lastly, the company is registering an Indian entity for WeChat Pay.

With this, Tencent wants to jump into digital payments space where the competition is really tough as we have seen multiple national as well as international players introducing UPI-based payments solution. We have Paytm Payments bank, Airtel Payments Bank, TrueCaller, Hike, PhonePe and more that offer digital payment solution based on this solution. Apart from this, we have international brands like Google with Google Pay, Amazon with Amazon Pay and even the messaging application WhatsApp allows payments through UPI.

Starting with Paytm Payments Bank, the company is offering a host of lucrative offers with its UPI payments in the form of cashback. Plus, with the banking services it is offering 4 percent interest on savings accounts and up to 8 percent interest on fixed deposit amount. Airtel Payments Bank, on the other hand, is also offering some interesting cashback offers through its Banking service and payments made with UPI.

Google Pay is already available on over 2,000 applications and websites. The Cupertino-backed payments application is quite simple to use and it is offering time-to-time cashback offers to its customers. The company recently partnered with Uber to provide up to Rs 1,000 cashback when customers make payments through Google Pay.

Xiaomi has already entered the Indian digital payments space with its Mi Pay that works with UPI. The company will roll out the application on all its smartphones, which will provide a seamless way to transfer money using this solution. The mobile payment service can also be used to check the bank balance, pay utility bills like broadband, DTH, electricity, gas, mobile, landline, and more, and lastly, recharge phone balance.

Truecaller has adopted a different route and has integrated UPI-based payments right in its applications. This provides a lot of flexibility in order to send money to other users right from the application. Amazon has also jumped into UPI payments solution recently with Amazon Pay UPI. The e-commerce site is digital payments solution for its user base for a while now and it is currently offering interesting cashbacks on the transactions made with Amazon Pay UPI.

For Tencent, providing time-to-time cashback offers and partnering with different platforms will be a major challenge. WeChat from Tencent was a failed attempt for Tencent to reach Indian consumer and it would be interesting to see whether it will be able to make its presence felt in the payments space with its upcoming service.