A report released by Analysys Mason states that the number of mobile social network users in India is expected to reach around 72 million by 2014.

The main drivers for this growth will be the falling smartphone prices in India, along with the launch of 3G services. Other factors influencing this growth are innovative data tariffs, initiatives by operators as well as handset manufacturers etc.

“Innovative data tariff plans (daily, weekly and monthly plans), and significant reduction in data charges are driving adoption of data-based services such as social networking,” says Sourabh Kaushal, principal consultant, Analysys Mason.

The report suggests that both, the operators and handset manufacturers need to expand their addressable base of consumers and focus on service innovation to increase the penetration of social networking in India.

“Operators are launching services such as pay-per-site tariffs and are expected to promote social networking applications to drive adoption of data services among their subscribers,” explains Kaushal.

He adds, “Handset manufacturers have also started to launch mobile handsets specifically designed for social networking in order to increase the value proposition and differentiate their devices.”

Young people and young professionals are driving the adoption of mobile social networking in India, accounting for 70 per cent of the total users in 2009. In terms of gender, males account for 56 per cent of the total mobile social network users in India, the report adds.

72 million mobile social networking users in India by 2014

Nokia launches E5

The Finnish handset manufacturer, Nokia, today announced the launch of E5-00 in its Enterprise phone portfolio.

The Nokia E5-00 runs latest Symbian S60 3rd edition and boasts of over 18 hours of talk time. Other features include business and consumer email, chat, social networking, 5.0 Megapixel camera etc.

The phone also comes packed with Nokia Messaging, allowing users to access email on the go with support for multiple email accounts, including popular mail services such as Ovi Mail, Yahoo! Mail, Gmail, Windows Live Hotmail.

The handset priced at Rs 12,699 will initially be available in two colours Carbon Black and Chalk White.

Other E series devices available in India are the E 71, E 63 and E 72.

Kaspersky to launch security solution for Android in November

Kaspersky Labs is working on a security solution for mobile handsets running on Google’s Android platform. The solution will be launched in November this year, informed Jagannath Patnaik, director, channel sales, Kaspersky Labs.

Kaspersky is an anti Virus solutions provider for laptops and PCs that has now forayed into the mobile space as well. The company has already started providing security solutions for Windows, Symbian and Java mobile platforms.

Kaspersky is targeting a subscriber base of one million subscribers by the end of next year with its mobile security solution, and is hopeful of garnering many more subscribers.

The mobile security segment is at a very nascent stage but Patnaik believes that the Indian market has huge potential.

He says, “In India we have close to 700 million mobile subscribers and around 7-8 per cent users own a smartphone. Currently, only 0.5-1 per cent of smartphone users use security software. Hence, the scope is tremendous.”

“Globally the phenomenon is picking up, especially in developed countries. In India, it will take around two years to boom,” he adds.

Going forward, the company aims to tie up with mobile operators and handset distributor networks for marketing the product. The revenue sharing model, informs Patnaik, will depend on the level of commitment from the operators and distributors.

Kaspersky believes that it is essential to educate people for its success in this space, and the company will work towards this aim aggressively during the next calendar year.

Wynncom launches two new devices

Wynncom Mobiles has announced two new dual SIM devices in their portfolio, Y90 and Y99.

The dual SIM devices have been touted as phones for young fashion enthusiasts. Arvind R Vohra, co founder and managing director, Wynn Telecom, said, “These models were developed keeping the trendy, young and enthusiastic generation in mind, for whom a mobile phone is a fashion statement.”

Y90 comes with a motion sensor which enables users to change wallpapers and songs by moving the phone in a particular way.

The device also has features such as schedule SMS, Indian calendar, background noise changer, torch, answering machine and FM alarm etc.

Y99 on the other hand comes with a preinstalled mobile application developed by160by2.com which enables mobile phone users to send free SMS messages to any mobile in India or in the UAE, Kuwait, Saudi Arabia, Singapore, Malaysia and Philippines. Other than this, the phone sports a 2 Megapixel camera, mobile tracker, expandable memory up to 4GB etc.

The devices Y90 and Y99 are priced at Rs 2,895 and Rs 3,895 respectively.

The rise of the tablet

A tablet or a tablet PC is a flat touchscreen portable computer, which works with a stylus, digital pen or with fingers. Technology research firm IDC says that devices with 7-12 inch colour displays, harnessing ARM-based processors and running on lightweight operating systems such as Apple’s iOS and Google’s Android OS can be classified as tablets.

At present, the tablets can run on a number of operating systems, namely, Apple iOS, Microsoft Windows and Android.

However, there is major confusion around the word ‘tablet’. There are some who go by the definition given by IDC (above), and others who say that tablets can be classified into three types – slates, convertibles and hybrids.

Slates are the most popular of all forms and resemble a writing slate. Users can work on them using their fingertips or a stylus, or using an external keyboard. They usually come with a screen size of 8.4 to 14.1 inches.

Convertibles have an attached keyboard, and are usually heavier and larger than slates. The keyboard is attached to the screen at a single joint called a swivel hinge or rotating hinge, which allows the screen to rotate through 180 degrees.

Hybrids are a combination of slates and convertibles, and come with detachable keyboards.

Tablets available and awaited internationally

The most popular tablet today is Apple’s iPad. The 9.7 inch touchscreen tablet was launched by Apple in January this year, and by the end of July, the company had sold 3.27 million units. As of now, the device is not available in India.

Dell Streak or Dell Mini 5 is another biggie that is much awaited. Google’s Android operating system based Mini 5 will come with a five inch touchscreen and will be driven by a Qualcomm’s 1GHz Snapdragon processor. Mini 5 is currently available only in three countries, and is expected to be launched in India by the end of this year at a price of about Rs 25,000.

UK-based company X2 had launched a tablet called iTablet in April. X2’s tablets are available in a range of screen sizes starting from 10 inches and going up to 12.1 inches. These devices are powered by 1.6GHz Intel Atom processors and run on Windows 7.

ASUS will launch the ASUS Eee Pad globally in the first quarter of 2011. The Eee Pad EP121 will feature a 12.1 inch touchscreen, and will be powered by an Intel core duo processor.

Another model of Eee Pad, EP101TC, will be launched simultaneously by ASUS. The tablet will have a 10 inch screen. Alex Huang, country manager for systems, ASUS India, says, “While it’s a little early to bet on huge success for tablet PCs that will be launched in India, we have received encouraging feedback at the debut of the ASUS Eee Pad and Eee Tablet at Computex 2010 held in June.”

“We are, however, confident that tablets will be assimilated easily into the Indian market, as a separate segment, since the Indian IT market has huge potential and the number of people who are turning tech savvy is increasing by the day,” he adds.

Another popular tablet internationally is the Lenovo IdeaPad U1. The hybrid, which can function as both a laptop and a tablet, will be launched in China early next year. It features an 11.6 inch screen and runs on Windows 7 till the screen is attached to the keyboard. When detached, the touchscreen operates as a tablet on a Linux operating system.

Lenovo also has plans to launch a tablet PC called LePad which will run Android OS. The device is expected to be launched at the end of this year.

Lenovo’s chief marketing officer David Roman had told The Wall Street Journal that the company is yet to decide if the IdeaPad U1 will be sold as a hybrid PC, or whether the company will sell the tablet portion of the computer as a standalone device.

Chinese telecom equipment company ZTE also is reportedly developing a tablet, called SmartPad V9. The device will run Android 2.1 and feature a 7 inch touchscreen. SmartPad will be launched later this year in Europe, Latin America, and the Asia-Pacific region.

Taiwanese electronic giant Acer is also going to launch two Android-based tablets globally by the end of this year. The 7 inch and 10 inch tablets will run Android 2.2, and will be powered by an ARM processor.

Last but not the least; HP too is slated to come out with a tablet by the end of this year. The HP Slate will have an 8.9 inch display and will run on Windows 7. The device will be priced at about $545, but there is no word around its launch in India.

Tablets in India

According to IDC, the market for tablet PCs in India is below 1,000 units a quarter. Still, there seems to be a lot of hope around these devices. This is evident from the increasing number of electronic and IT giants planning to launch tablets in India.

Huang of ASUS says, “Since tablets are a niche product offering, they are expected to be in good demand from consumers who want to play all kinds of flash videos and other interactive content which will be made available with the large number of applications that we are designing. Besides, touch interface is one of the most intuitive and natural interfaces to use.”

The Olive Pad VT100, developed by Olive Telecom, is the only tablet currently available in India.

Android-based 3G Olive Pad was launched in the country in July at a price of Rs 25,000. It comes with a 3 megapixel camera, and a lower resolution front camera for video conferencing. The device can also be used as a notebook with touchscreen. Olive expects to sell around one lakh units of Olive Pad by February 2011.

Another very popular tablet to be released in India is the so called $35 tablet,(or about Rs 1,500) device called Sakshat which is to be officially launched early next year. The device has been developed by students of the Indian Institute of Technologyand the contract to manufacture the affordable touch screen has been given to HCL Technologies.

Sakshat, which is targeted at students in the country, was showcased by the Union Minister for Human Resource Development Kapil Sibal. The tablet will support web browsing, video conferencing and word processing, according to its developers. It is based on Linux and has 2GB of RAM and USB ports, but does not have a hard disk.

Apart from the obvious iPad, other tablets awaited in the country are Samsung’s Galaxy Tab, BlackBerry PlayBook, Dell Mini 5, ASUS Eee Pad and Huawei SmaKit S7.

Samsung Galaxy Tab is expected to hit the Indian market in October. The 7 inch tablet is expected to be priced at approximately Rs 40,000 in India. Galaxy Tab is Samsung’s first Android tablet and will run Android 2.2 Froyo. It features a 1GHz processor, 7 inch TFT screen, and support for WiFi and 3G. Research in Motion’s BlackBerry PlayBook is likely to be available in the USA in early 2011 while roll outs in other markets will start in the second quarter of next year. The tablet has a 7 inch display and is powered by a 1GHz dual core processor, 1GB of RAM and the new BlackBerry Tablet OS. It also supports Adobe Flash Player 10.1, Adobe Mobile AIR and HTML 5. There is no word on its launch in India.

Huawei too has plans to enter the tablet market in India. Its Smakit S7 Android tablet which had been showcased at the Mobile World Congress will soon be introduced in India. SmaKit S7 has a 7 inch screen and supports information sharing across screens to present the same content simultaneously on computers, mobile phones and TV screens.

APAC to drive tablet growth

IDC expects tablet shipments in the Asia Pacific excluding Japan region to grow from 1.3 million units in 2009 to 9.6 million units in 2014, representing a compound annual growth rate (CAGR) of 65 per cent.

Bryan Ma, associate vice president, Asia Pacific devices and peripherals research, IDC, says, “IDC remains cautiously optimistic about the longer term potential of the tablet segment. In Asia in particular, the iPad is likely to spark off intense competition from Asian brands, leading to a wealth of offerings in varying price tiers.”

“With operators migrating towards 4G networks in the coming years, media tablets will further become a strategic vehicle for increased Mobile Data usage. There are certainly roadblocks, but the media tablet appears here to stay,” Ma concludes.

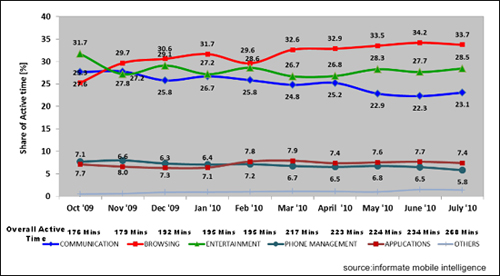

Content consumption increases; voice stagnates: Informate

A report by Informate Mobile Intelligence says that the methods used for communication through mobile phones has evolved and while there is an increase in the share of time spent on browsing and on various entertainment activities on smartphones,time spent on voice calls and Messaging has declined in India.

Kedar Sohoni, president, Informate Mobile Intelligence, says, “We have seen huge increase in content consumption over the past months. However, one area which has remained stagnant is voice.”

Sohoni adds, “The increase in data usage is not just in terms of minutes of usage but also depth. People are not just visiting the same two to three sites every time; they are expanding their reach.”

In fact, a mobile metrics report shared by the company reveals that time spent by users on voice calls in July this year is the same as that in October 2009. In July this year and October 2009 voice calls contributed 24.2 percent to the total time of 61.9 minutes and 48.7 minutes, respectively, spent on mobile phone communication by each user.

The total time spent on communication, however, has shown an increase owing to increase in use of chat and email services.

The report also states that the share of browsing in overall mobile usage showed an increase. Time spent in web browsing through mobiles increased from 27.6 per cent of total time spent on mobile communication in October 2009 to 33.7 per cent in July this year.

Telecom research agency Informate Mobile Intelligence studies usage patterns of,3,000 smartphone users daily. Although Informate Mobile Intelligence has been tracking the mobile market in India for the past 15 months, it has been commercially active for the last six months.

LG Mobile ties up with Fifth C for BlacMail push email services

Fifth C, mobile application and technology provider, and LG electronics have entered into a partnership to offer BlacMail push mail solution on LG mobile phones.

The latest LG Cookie Glide, GT350i phone incorporates real-time push email updates powered by BlacMail.

Other that this the device touted as a Messaging devices comes with a 4 line QWERTY keyboard, 3 inch resistive touch screen, integration with sites like Facebook and Twitter and a 2.0 Megapixel camera. The keypad has dedicated buttons for social networking sites.

Motorola rolls out two dual-SIM handsets

Motorola India Private Limited has introduced its first two Dual-SIM handsets in India – EX128 and EX115.

The Motorola EX115 is a dual-SIM QWERTY phone and the Motorola EX128 is a touchscreen dual-SIM phone with stylus. Both the models offer social connectivity, 3 MP camera, video camcorder, large colour display and an expandable memory of up to 32GB.

Faisal Siddiqui, country head of India, Motorola Mobility, said, “One of our key focus segments is the dual-SIM market, a rapidly evolving market in India. Experience and enjoy the Motorola EX 128, a smarter choice that can be used with ease, and the Motorola EX115, a social Messaging device to stay in touch and in control.”

Both the handsets are available at retails outlets in India. The Motorola EX128 is priced at Rs 6,990 and the Motorola EX115 is priced at Rs 5,990.

Samsung, Netbiscuits tie up for bada OS

Netbiscuits, a development and publishing platform for mobile web sites and apps, has announced a partnership with Samsung Electronics.

Based on this partnership, Netbiscuits’ premium customers will be provided with apps made for Samsung’s recently launched mobile operating system – bada.

All apps will be implemented as native hybrid applications, a combination of website and app. This approach allows Netbiscuits customers to manage mobile sites and apps for multiple platforms using one single, cloud-based software system.

The first Netbiscuits’ customers to be enabled with Samsung bada native hybrid apps include Axel Springer, Spiegel Online, IDG Germany and kicker online.

The new apps will provide access to services like Immonet.de, Spiegel Mobil, PC-Welt, GameStar, CIO, TechChannel, ComputerWoche, kicker Mobil and Stau Mobil.

Michael Neidhoefer, CEO of Netbiscuits, said, “The native hybrid apps concept enables App store operators to populate their stores fast and help content and service providers to set up and manage mobile websites and apps cross-platform in a cost-efficient way using Netbiscuits cloud-based software system.”

Aircel ties up with Apollo for Mobile HealthCare services

Aircel today announced the launch of the their Tele Healthcare initiative, Aircel Apollo Mobile HealthCare, in association with Apollo Hospital Groups.

These would initially include services like Tele Medicine and Tele Triage.

Tele Medicine provides interactive healthcare in real-time allowing the patients to consult physician /specialist over video for immediate health care. The patient data is collected through various processes like history, data-entry, Biometrics and integration of medical equipment. The data is stored and shared between healthcare professionals to diagnose, treat and follow-up be it (regular treatment, post–surgery etc). This will be available at exclusive Aircel Retail outlets and at other Retail outlets as well.

The consultation cost for the service would be Rs 250.

The services will be rolled our in Chennai. Gurdeep Singh, chief operating officer, Aircel said, “We will roll-out our services from Chennai and gradually go Pan India.”

On the other hand, Tele Triage is a solution to manage patient health concerns and symptoms via a telephone interaction by doctors anytime, anywhere. A customer would be charged Rs 45 per consultation for this service.

Singh added, “This service is a customer retention tool and we are not looking at it as a major revenue generator. It is a part of our customer service initiative.”